Paul helpfully noted here Friday the Josh Barro article about why the economic recovery under Obama has been the weakest on record. (Shorter Barro” “It’s the Obama, stupid!”) The good folks at The Daily Shot offer some interesting charts that help visualize the story.

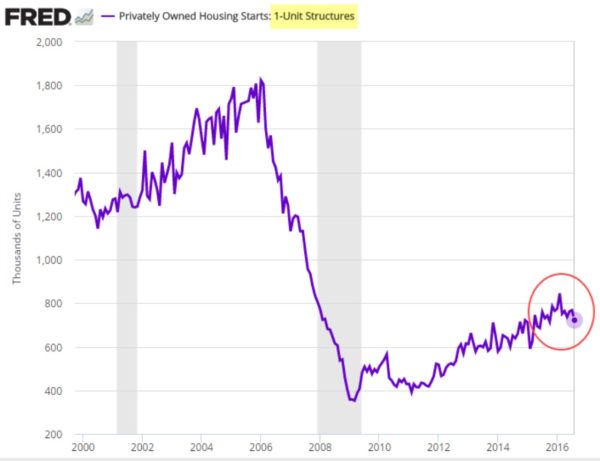

Usually after a recession the housing sector contributes significantly to an economic rebound. This did not happen after the crash of ’08, and as you can see from the first figure below, but the housing sector may be ticking downward just now. Maybe we built too many houses during the bubble, but even Jerry Brown out here in CA thinks we’re not building enough housing.

Meanwhile, manufacturing of capital goods is looking anemic right now after a typical post-recession rebound back around 2010:

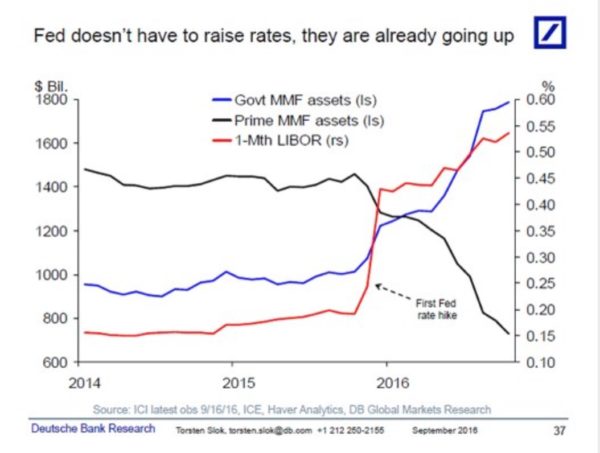

And repeat after me: The Federal Reserve does not control interest rates. The Federal Reserve does not control interest rates. Repeat as many times as necessary until you understand that the market determines interest rates. The Fed only controls the shortest term interest rates between banks. As the next figure shows, the market is already pushing up interest rates.

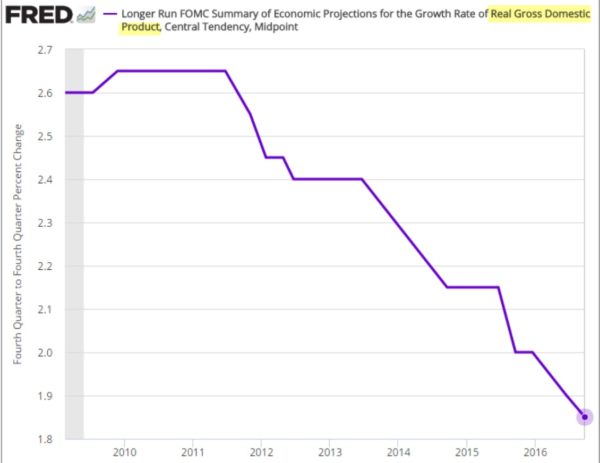

And almost unnoticed at last week’s Fed announcement that it was standing pat on its short term rates was the fact that the Fed is lowering its economic growth forecasts:

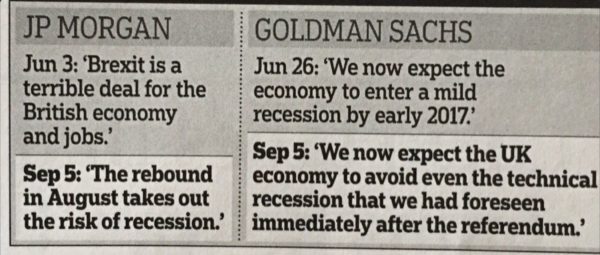

Hmm. Starting to look like the next president is going to face a recession. But maybe an American version of Brexit will “trump” all of this (heh—irony deliberate). Someone caught this nice juxtaposition of what the Certified Smart People said about Brexit:

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.