Anyone remember the early 1990s when the Clinton Administration discovered to its horror that it couldn’t spend like the horny drunken sailors we know them to have been because the bond market would instantly punish the economy? James Carville famously said that if he was reincarnated, he wanted to come back to earth as the bond market. Hold that thought in mind as we survey the current economic scene a little more closely.

Liberals told us that the corporate tax cut bill was a sop to the rich, etc. Yet lots of solid economic studies found that our high corporate income tax rate had a depressing effect on workers’ wages, and that a cut in the corporate tax rate would be a boost to wages. In the immediate aftermath of the tax bill’s passage the number of big companies passing out bonuses to workers (usually $1,000) and/or raising wages is up over 30. Yesterday, citing the tax cut, Waste Management announced it will give out $2,000 bonuses to nearly 34,000 employees. And WalMart announced that it will raise its starting wage to $11 an hour, increase fringe benefits, and will give out bonuses of up to $1,000 to most employees depending on length of service. And Pepco and Washington Gas, the public utilities for the Washington DC area, say the tax cut will allow them to reduce rates for their customers. That’s more money in everyone’s pockets.

This is happening for a simple reason: one of the largest factors for corporate finance is the cost of capital—whether that capital is raised through borrowing, issuing equity, or from the internal rate of return on the business’s own cash flow (and anyone who has ever taken a finance class will know how tricky doing the IRR calculation can be). And the cost of capital is set by the marketplace. All businesses have to achieve a rate of return that assures their continued access to capital, and when that cost falls it enables a company to maintain a competitive return while raising wages. The significant reduction in the corporate tax rate has lowered the cost of capital across the board. Other countries are quickly following the U.S. in cutting their corporate tax rates to remain competitive. Japan, Australia, Austria, even Argentina and France (!) have announced plans to cut their corporate tax rates, and several other nations indicate they won’t be far behind.

And liberals furious about this!

Writing at The American Interest, James S. Henry laments the fact that other nations are going to have to cut taxes to keep up with the U.S.

Not even a single day into this new law’s existence, there are already signs that our worst fears about its dire global effects have been confirmed. Far from leading quickly to higher U.S. economic growth, more jobs and higher wages, the deep corporate tax cuts contained in this bill have already triggered, or at least substantially accelerated, a global tax war—an aggressive “race to the bottom” in international corporate tax rates, rules, and regulations that will be deeply harmful. . .

Remember the old saw about how liberals like to blame America first? Since we previously had the highest corporate tax rate in the industrialized world, maybe Henry should be blaming Ireland and other low-tax countries for forcing the U.S. to match them. In other words, we didn’t start the “global tax war.”

Just who is James S. Henry, by the way? He is identified at The American Interest as “an investigative economist and lawyer. . . a senior fellow at the Columbia University’s Center on Sustainable Investment, a Global Justice Fellow at Yale, a senior advisor at the Tax Justice Network.” Just what is an “investigative economist”? Whatever it is, I expect Henry would like to be reincarnated some day as the corporate income tax rate.

What we are seeing here is a lesson is how left and right see the best strategy to help the economy. Liberalism likes to bribe people with their own money, which requires taking it from them first. It helps when you can target the funds to your favored groups, instead of letting the chips fall where they may when you let people keep their own money as tax cuts do. Freedom is like that.

Instead of having a lower cost of capital put upward pressure on wages, liberals are only happy when wages rise because of a government mandate. Liberals especially love mandating a higher minimum wage. How’s that working out? We’ve reported before (here and here) about how it is backfiring in Seattle, especially the NBER study (commissioned by Seattle) that found “the second wage increase to $13 reduced hours worked in low-wage jobs by around 9 percent, while hourly wages in such jobs increased by around 3 percent. Consequently, total payroll fell for such jobs, implying that the minimum wage ordinance lowered low-wage employees’ earnings by an average of $125 per month in 2016.” Nice going, Seattle.

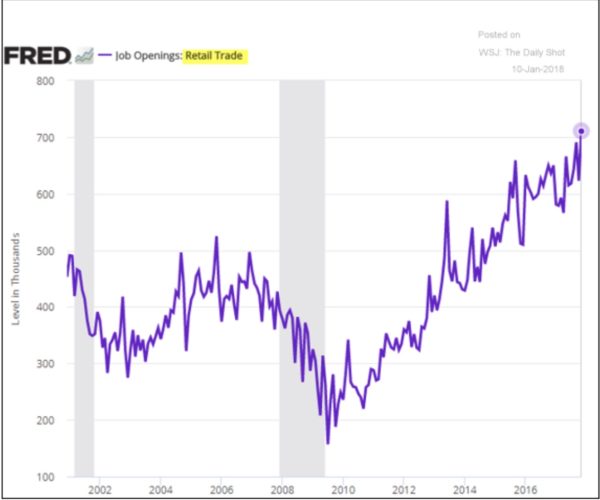

P.S. You know how we keep hearing that Amazon and other “e-tailers” are killing bricks and mortar retailing? Well maybe so. Yet according to the Federal Reserve, retail job openings are at a 15 year high right now.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.