Paul Krugman is a partisan hack, so I don’t take anything he says seriously. Still, it is interesting, as Dan Mitchell points out, that Krugman subscribes to the Laffer Curve:

I’ve been writing about the Laffer Curve for decades, making the simple point that there’s not a linear relationship between tax rates and tax revenue.

To help people understand, I ask them to imagine that they owned a restaurant and decided to double prices. Would they expect twice as much revenue?

Of course not, people respond. Customers would go to other restaurants, or decide to eat at home. Depending on how customers reacted, the restaurant might even wind up with less revenue.

Well, that’s how the Laffer Curve works. When tax rates change, that alters incentives to engage in productive behavior (i.e., how much income they earn). In other words, to figure out tax revenue, you have to look at taxable income in addition to tax rates.

For some odd reason, this is a controversial issue. But it shouldn’t be, because even Paul Krugman agrees about the Laffer Curve.

Dan embeds a video in which Krugman acknowledges as much. But, as Dan goes on to say, there isn’t really any doubt that at some point, taxes get so high that they choke off economic activity and therefore revenue. Even Paul Krugman agrees with that. The first question is, where does that happen?

Folks on the left often say tax rates could be 70 percent while folks on the right think the revenue-maximizing rate is much lower.

I have two thoughts about this debate. First, if the revenue-maximizing rate is 70 percent, then why did the IRS collect so much additional revenue from upper-income taxpayers when Reagan lowered the top rate from 70 percent to 28 percent?

This is where Mitchell makes the really important point: since when is our goal to maximize tax revenues?

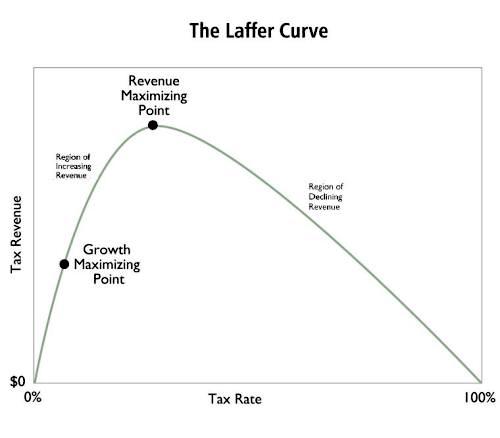

Second, I don’t want to maximize revenue for government. That’s why I always make sure my depictions of the Laffer Curve show both the revenue-maximizing point and the growth-maximizing point. At the risk of stating the obvious, I prefer the growth-maximizing point.

I suspect that the revenue-maximizing point lies farther to the right than Dan illustrates, simply because almost everyone has to work. You can stop patronizing a restaurant if it doubles its prices, but you still have to feed your family. So for most of us, the disincentive to work kicks in, I think, at a pretty high level. The disincentive to invest is something else; it seems obvious that for people who already have money, the expected rate of after-tax return is a prime driver of decisions.

But Mitchell makes a real contribution in articulating the difference between revenue-maximizing and growth-maximizing tax rates. The purpose of government is not to squeeze the largest possible amount out of its citizens. The purpose of government is to carry out its legitimate functions as efficiently as possible, so as to enable the lowest reasonable tax rates. If those rates result in more revenue, as Milton Friedman once said, that means you haven’t cut them enough.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.