It used to be that liberals cried foul if you accused them of indulging is class warfare, but day by day it becomes apparent that the left has shed this faux bashfulness and has decided that it must demonize billionaires as a class.

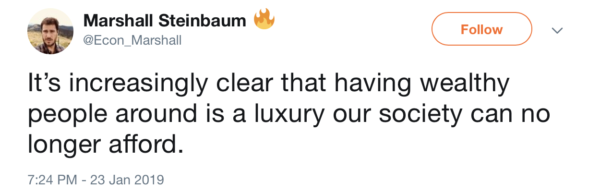

In a previous Loose Ends I noted how lefty agitator Marshall Steinbaum had offered up clear hate speech for rich people, which apparently cost him his Twitter account:

It is but a short step from this sentiment to “liquidate the kulaks.” But you might have expected better than this from Robert Reich, who does Steinbaum one better in the sweepstakes competition to become the top commissar of the Kamala Harris Regime:

It is an astounding proposition that no one could have earned a billion honestly. Question to Prof. Reich: Does this apply to Oprah? Was her monopoly on herself illegitimate? Should it have been broken up . . . somehow? How about Paul McCartney, who also has a net worth north of $1 billion? Is his ownership of his songlist and recordings illegitimate or immoral?

Which brings me to the subject of the wealth taxes that are suddenly popular with the left. Sen. Elizabeth Warren proposes an annual 2 percent wealth tax on everyone with assets over $50 million, which, she claims, would only affect about 75,000 American households, and would yield maybe $3 trillion dollars over a decade. (This, along with a new 70 percent marginal income tax rate starting at $10 million, which might bring in $7 trillion—both taxes still far from sufficient to fund the current spending wish list of the left.)

Quite aside from the technical problems of imposing such an annual wealth tax (it would soon run into significant liquidity problems, which would affect underlying asset valuations, which would cascade in various negative ways into capital markets, at which point liberals will blame Wall Street all over again), does anyone really believe that these kind of taxes would remain limited to just the very rich?

Since the left loves to point to the social democracies of Europe as their model nirvana, it is worth pointing out that their high income tax rates start at decidedly middle class levels. Denmark’s 60 percent top income tax rate starts at around $55,000 of income. Sweden’s is similar. What those social democracies know is that if you’re going to fund a lavish welfare state, you have to tax the middle class heavily, because that’s where the money is. There just aren’t enough rich people to loot to pay for all of the goodies. Don’t forget that Sweden, Denmark, and the other social democracies also soak the middle class with a 25 percent value added tax on just about all purchases—a tax so regressive that even our money-grubbing liberals won’t touch it with a ten-meter pole.

Which is why the next question is: Why would any sentient human being believe that the left would limit higher income tax rates and a wealth tax on just the very very rich? The critics of the original income tax when it was proposed in 1913 said that it might someday reach ten percent on the highest incomes! We know how that worked out. If we ever get Sen. Warren’s wealth tax, you can be assured that it will very quickly be extended downward to anyone with a decently funded 401K.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.