I’m tempted to suggest that the feel-good news story of the week is “UN To Run Out of Money by End of Month, Secretary General Warns.” Aww, wouldn’t that be a shame.

But no, by far the the best stand-up-and-cheer-for-‘Murica story this week is “Team Allegedly Sets New ‘Cannonball Run’ Record on Empty Highways During Coronavirus Lockdown.” Now that’s making the best of the bad situation, American-style! Me, I’m getting three weeks to the gallon on my car right now, and so admire and envy the lust for speed on the open road.

But it sets me to wondering whether the American economy will put the pedal to the metal when the lockdown ends, such that we’ll experience an economic Cannonball Run. We’re in uncharted territory, but unfortunately I wouldn’t bet big on a big boom coming out the other side.

Let’s consider one tiny bit of microeconomic data, and one bit of lagging macroeconomic data, that ought to make us worry. The microeconomic data is my own monthly credit card statement. For the first time in my life, I’m looking forward to getting my monthly credit card statement later this month. I’ve been too busy to check online, but I expect I’ll have a credit balance for the first time ever, on account of all the plane fights and hotel rooms I’ve had canceled and refunded over the last month, on top of the restaurant meals I’m not having and other retail purchases. I’m not even buying many books at the moment, since Amazon and other online sellers are delaying book shipments in favor of more urgent items (though for me, what could be more urgent than another book?).

Move on beyond people still employed like to me to the millions who have lost their jobs, and the many lightly capitalized small businesses operating on thin margins that may not come back from this, and you have a situation in which everyone is hoarding their dollars like it was toilet paper. This happened in the housing bust of 2008-2009—consumer spending, a backbone of the economy—was very slow to come back.

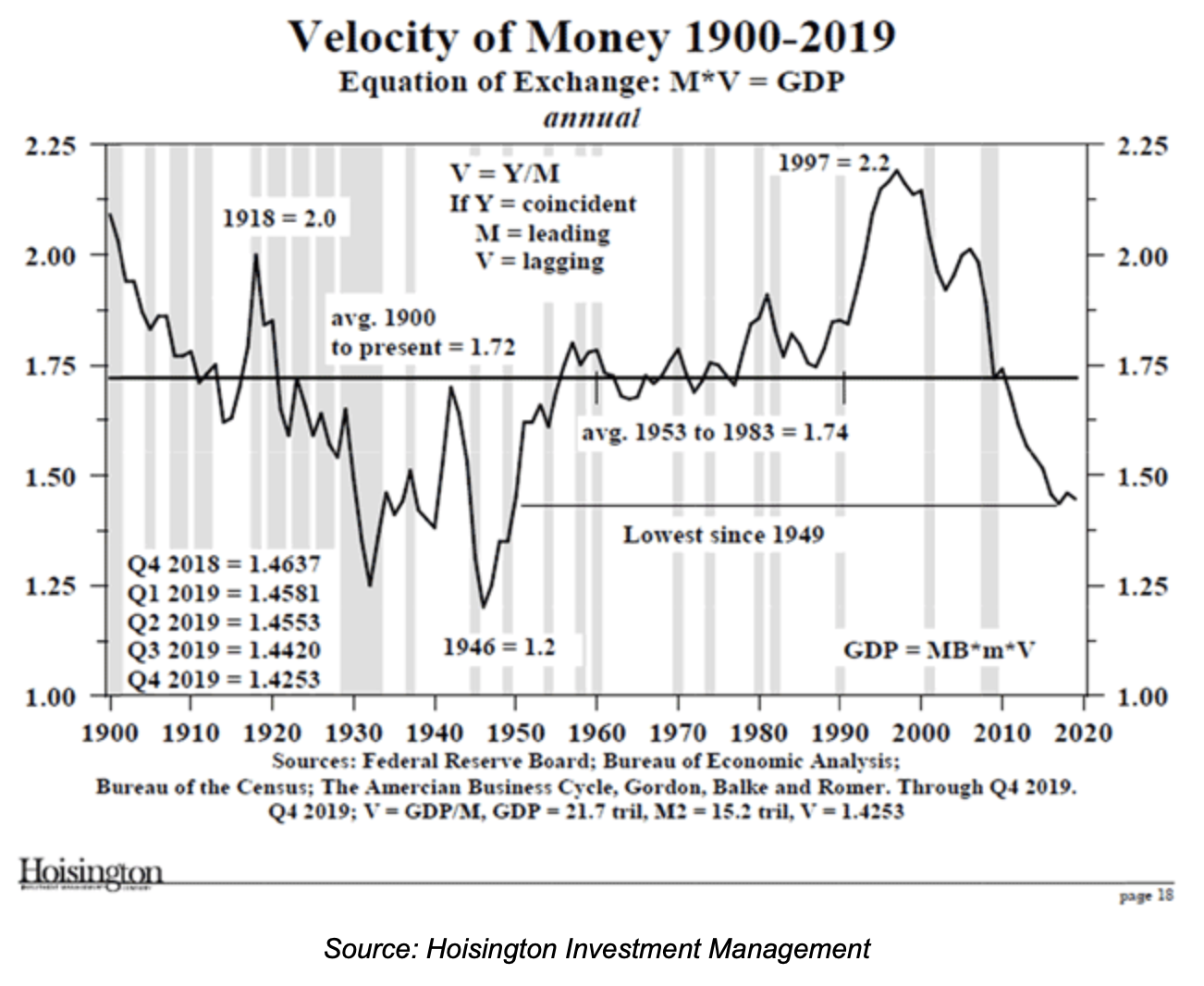

This is what monetary economists call “velocity”—the rate at which the money supply turns over. It’s the “V” part of Milton Friedman’s famous basic macroeconomic equation, “MV=PQ,” where M is the money supply, P is the price level, and Q the quantity of output (or short for GDP). Milton was famous for saying that inflation is everywhere and always a monetary phenomenon, and although the Fed’s monetary moves right now represent a frightening expansion of the money supply, a fall in velocity will mitigate the inflationary effect, perhaps for years. (The nearly insatiable foreign appetite for the dollar also complicates any simple inflation expectations from the money supply alone.)

Economist John Mauldin passes along this chart from Lacy Hunt of Hoisington Investment Management of the simple velocity measure from 1900-2019, and you’ll see that velocity was already falling at the end of 2019, and has surely fallen much further in the last 45 days.

The point is, even if 80 percent of the pre-crisis economy comes back by mid-summer, you’re still looking at a major recession, if not a near depression. Mauldin, by the way, has been predicting for the last couple years that a recession would see the federal budget deficit soar to $2 trillion. Now that would be regarded as “the good old days.” This year’s federal budget deficit is more likely to be over $4 trillion. And that may be optimistic.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.