Even the Biden White House is capable of readings the polls, and all of the recent surveys show that Americans are hopping mad about high gasoline prices, and are blaming Biden for it. The Putin excuse isn’t working, nor are Americans flocking to buy electric cars.

Today the Biden Administration announced that it is considering releasing another 180 million barrels of oil from our Strategic Petroleum Reserve (SPR), after having already released 30 million barrels from the SPR less than a month ago. Details are lacking at the moment. The White House says Biden will deliver remarks at 1:30 p.m. ET on “his administration’s actions to reduce the impact of Putin’s price hike on energy prices and lower gas prices at the pump for American families.”

Some facts and figures: The SPR currently holds 568.3 million barrels, which means Biden’s proposed withdrawal amounts to about a third of the total inventory of the SPR.

Second, 180 million barrels represents nine days of oil use in the U.S. Maybe this is why the release of 30 million barrels a few weeks ago hasn’t had much effect. Reuters reports:

“Historically, SPR releases have temporarily sent oil prices lower and are then followed by higher prices as the market prices in insufficient supply,” said Josh Young, chief investment officer at Bison Interests. “It is likely that oil prices rise after an initial temporary pullback, and that the SPR may have to be refilled at even higher prices.” . .

But longer-term, the key to rebalancing the market is increased commercial production, not stockpile drawdowns.

“Stocks of strategic oil have a limit and flows of commercial oil do not. Flows that stop are a bigger problem than strategic stocks can solve over time,” said Kevin Book, energy policy analyst at ClearView Energy Partners in Washington.

Apparently Biden is frantically trying to get other nations to dip into their reserves along with us, and that our SPR release will be something like 1 million BPD for the next six months. Good luck with that.

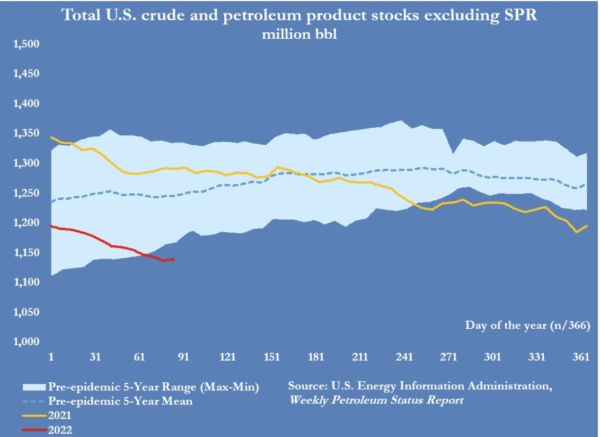

And this chart shows how our private sector domestic oil stocks have been declining for the last two years:

Nice going.

Of course, if Biden really wanted to put sustained downward pressure on oil prices, he’d reverse his decision to block the Keystone XL pipeline. There is zero chance he will consider this. The environmental base of the Democratic Party won’t allow it.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.