Americans’ standard of living has been hammered by inflation the likes of which we haven’t seen in decades. There has been lots of happy talk from the administration, but no one thinks prices are going down any time soon. What, then, is going to happen?

My colleague John Phelan offers an answer: prices should be rather stable for a while, unless the federal government embarks on a fresh money-printing spree:

[O]ur current inflationary problems are the result of the Federal Reserve printing trillions of dollars in a short space of time which it used to buy government and private sector financial assets when COVID-19 hit so as to keep the prices of those assets up and the cost of borrowing down.

Figure 2 illustrates this. It shows a sharp rise in the rate of growth of the Monetary Base.

A technical discussion follows. The chart shows in graphic form the extraordinary expansion of the money supply that the Fed engineered in 2020 and 2021:

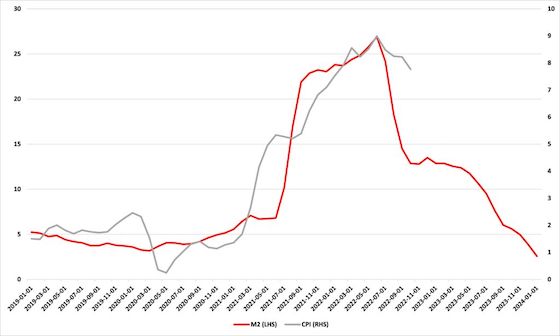

John then documented the relationship between the expansion of money supply and the CPI:

M2 is the money supply measure more closely tied to inflation as measured by changes in the CPI. As the amount of money increases relative to the goods and services available for it to be spent on, the prices of those goods and services is bid up: inflation.

But this process takes some time. How long? The peak annual rate of M2 growth was 26.9% in February 2021. The peak annual rate of CPI growth was 9.0% in June 2022, sixteen months later. If we push the data for M2 growth forward sixteen months so that the peaks match, as we do in Figure 2, we see another close fit. Inflation, as measured by the CPI, has been driven by expansion of the money supply, as measured by M2.

This is simple, but rather brilliant, as the fit is just about perfect if you posit a 16-month lag:

The conclusion: the current bout of inflation is winding down:

The relationships above give us a good basis to speculate on where inflation might be headed. The answer is ‘down’, and, perhaps, reasonably sharply. The rate of M2 growth is now back where it was before the pandemic. If this drives CPI growth, as the data suggest, then we can expect inflation to return to its pre-COVID-19 rate over the next sixteen months or so.

Let’s hope the Fed and the new Congress don’t screw it up.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.