Headlines like this from today’s Wall Street Journal make me smile and rush off to check on my fossil-fuel-heavy stock portfolio:

![]()

A surge in energy stocks is challenging climate-conscious money managers who beat the market for years when the sector struggled but are now missing out on Wall Street’s hottest trade.

The S&P 500 energy sector has rebounded 54% this year, outpacing the broad index’s 21% climb and leading the second-best performing group by about 16 percentage points. . . Investors who for years could easily eschew companies such as Exxon Mobil Corp. or Chevron Corp. must choose whether the possibility of rosy returns outweighs their climate considerations. . .

The percentage of fund managers holding a larger position in energy stocks than the benchmarks they track recently hit its highest level since 2012 in a monthly Bank of America Corp. survey.

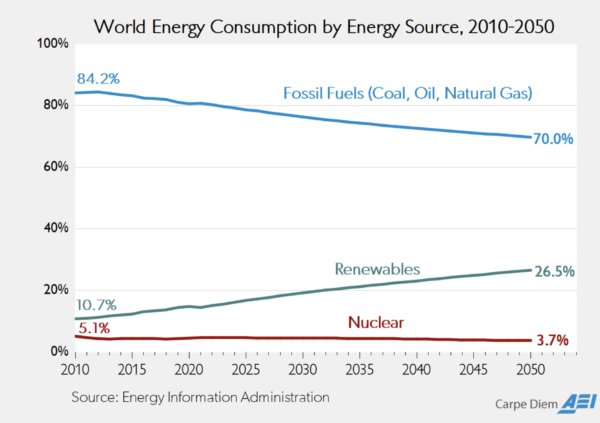

The old oil, gas, and coal stocks that all right-minded people are supposedly divesting from remind me of tobacco stocks in the late 1990s. If you bought them then, you made a killing. Reminder—if the energy forecast for the next 30 years from the best energy forecasters turns out like this, then you’ll make a lot of money in traditional “brown” energy:

UPDATE (from Bloomberg):

And concerning this climate question about getting to zero carbon emissions—if only there was a technology that delivered lots of 24/7 dispatchable electricity with no carbon. . .

Chaser:

Let’s go Brandon!

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.