A friend sent me a link to this paper, which says that, contrary to much of what we see in the press, Western sanctions are devastating Russia’s economy. The authors are all associated with Yale; subject to that caveat, here it is:

As the Russian invasion of Ukraine enters into its fifth month, a common narrative has emerged that the unity of the world in standing up to Russia has somehow devolved into a “war of economic attrition which is taking its toll on the west”, given the supposed “resilience” and even “prosperity” of the Russian economy. This is simply untrue – and a reflection of widely held but factually incorrect misunderstandings over how the Russian economy is actually holding up amidst the exodus of over 1,000 global companies and international sanctions.

That these misunderstandings persist is not surprising. Since the invasion, the Kremlin’s economic releases have become increasingly cherry-picked, selectively tossing out unfavorable metrics while releasing only those that are more favorable. These Putin-selected statistics are then carelessly trumpeted across media and used by reams of well-meaning but careless experts in building out forecasts which are excessively, unrealistically favorable to the Kremlin.

Our team of experts, using private Russian language and unconventional data sources including high frequency consumer data, cross-channel checks, releases from Russia’s international trade partners, and data mining of complex shipping data, have released one of the first comprehensive economic analyses measuring Russian current economic activity five months into the invasion, and assessing Russia’s economic outlook.

From our analysis, it becomes clear: business retreats and sanctions are catastrophically crippling the Russian economy.

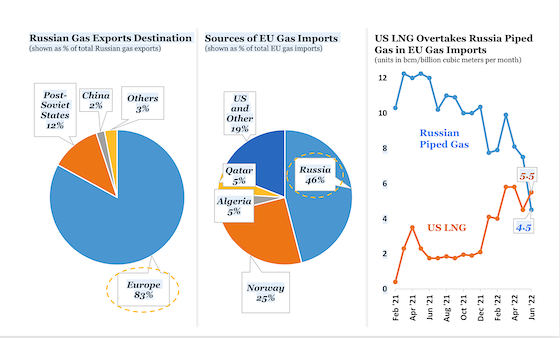

More at the link. You can also go here to see the slide show that summarizes the authors’ data. Again, there is lots of information, but here are a couple of slides. This one supports the authors’ argument that liquid natural gas is a more important export commodity for Russia than it is an import commodity for Europe; and moreover, that American imports of LNG now exceed imports from Russia:

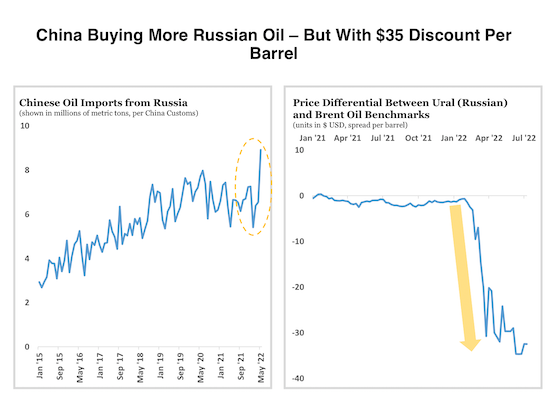

This one says that while China is buying Russian oil to partly replace exports to Europe, it is doing so at bargain prices:

This one is particularly interesting to me: “Kremlin Inundating Economy With Artificial Liquidity To Mask Economic Weakness.” Gosh. Sounds familiar.

I will defer to the economists among our readers, but I would be surprised if our own M2 chart doesn’t look worse than that.

All of that said, I hope the authors are correct, and Western sanctions are having serious impact.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.