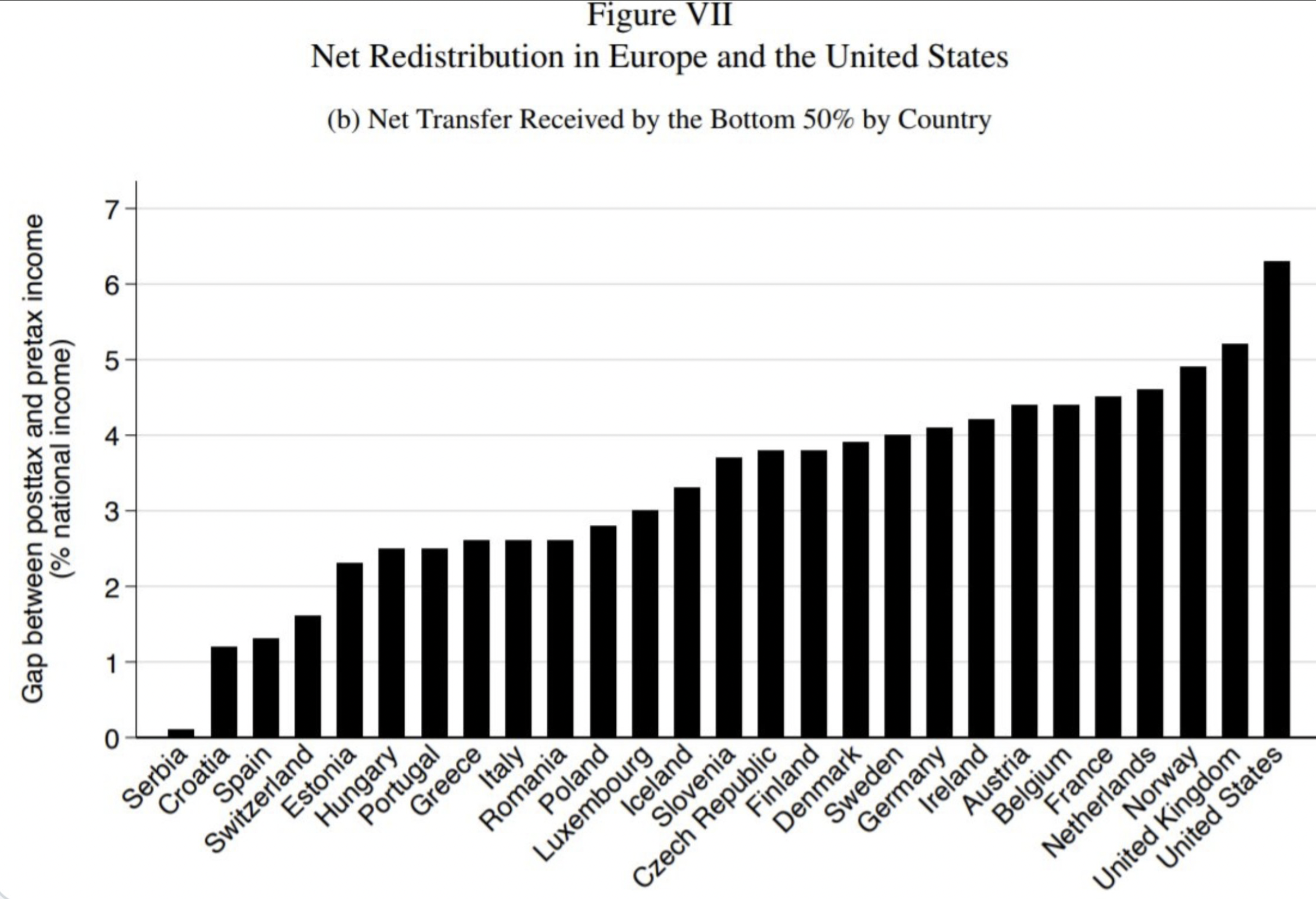

If you only know two things about progressives today, it is that they are obsessed with income inequality, and have a bad case of envy for Scandinavian socialism, endlessly suggesting Denmark or Sweden should be our model for social welfare policy. But guess which industrial democracy practices the largest redistribution of national income to the lower half of the income scale? Turns out to be . . . the United States. Behold:

The y-axis here intimates the all-important calculation of how income inequality in the U.S. diminishes considerably once you account for all of our income transfers and other social welfare spending, which most leftists leave out of their inequality jeremiads. It turns out that while U.S. income tax rates may be lower than European tax rates, in aggregate America’s tax system is more progressive than every European country:

Here’s the interesting thing: these findings appear in a brand new academic article from three left-leaning economists (one from Berkeley, the other two from the Paris School of Economics) that employs some novel deep dives into the data: “Why Is Europe More Equal Than the United States?” The article appears in the American Economic Journal: Applied Economics, and is behind a paywall, but the headline is misleading in many ways, as the study utterly blows up or throws serious shade on several favorite claims of egalitarian leftists.

One of the favorite leftist themes is that the U.S. has higher income inequality than Europe because of our (relatively) low income tax rates. But:

[T]he distribution of taxes and transfers does not explain the large gap between Europe and US posttax inequality levels. Quite the contrary: after accounting for all taxes and transfers, the United States appears to redistribute a greater fraction of its national income to the poorest 50 percent than any European country. This finding stands in sharp contrast with the widespread view that “redistribution,” not “predistribution,” explains why Europe is less unequal than the United States. . . indirect taxes and in-kind transfers are more progressive in the United States than in Europe overall. [Emphasis added.]

The authors also inadvertently embrace several key arguments conservatives typically make:

For example, high top marginal tax rates can limit top earners’ incentives to bargain for higher pay, decreasing pretax inequality. Transfers at the bottom of the distribution can also change incentives to work or acquire skills. [Emphasis added.]

A generous welfare state might be a disincentive to work? Perish the thought. Especially in an academic journal. I can’t believe the peer reviewers let this pass. (For more on this point, see Steve Moore and pals in the NY Post today.)

More:

The lower top marginal tax rates observed in the United States can only explain a small fraction of the Europe-US inequality differential. . . the decrease of top marginal tax rates does contribute to explaining the rise of top income concentration in Europe, but it cannot account for the higher pace at which pretax inequality rose in the United States. . . Since the United States redistributes a larger share of national income to the bottom 50 percent than European countries, a positive relationship between lower pretax inequality and higher redistribution cannot explain the differential between Europe and the United States.

In other words, stop blaming Ronald Reagan for the widening of income inequality.

The conclusion makes the repudiation of Robert Reich’s talking points explicit:

Against a widespread view, we documented that the structure of taxes and transfers cannot explain why Europe is less unequal than the United States today. On the contrary, redistribution appears to reduce inequality more in the United States than in Europe. . .

So how to the authors explain the different level of income inequality between the U.S. and Europe? (Let’s leave aside for another day the perverse obsession the left has with income inequality.) They offer a distinction between “predistribution” and “redistribution,” though “predistribution” is not very fully spelled out, but generally means better national health care, education, and labor market policies in the European social democracies:

Given that the two regions have been exposed in a relatively similar way to technological change and globalization in the past decades, our results thus shed light on the importance of predistribution policies, such as access to education and health care or labor market regulations, in explaining international differences in the distribution of pretax income growth.

It would be interesting to see the study extended to include careful statistical analysis of differing demographics, immigration levels, and educational attainment between the U.S. and Europe. I’ll bet the charts such a treatment would generate will be equally unflattering to the egalitarian left. Kudos to the authors of this paper for reporting findings contrary to their “priors.”

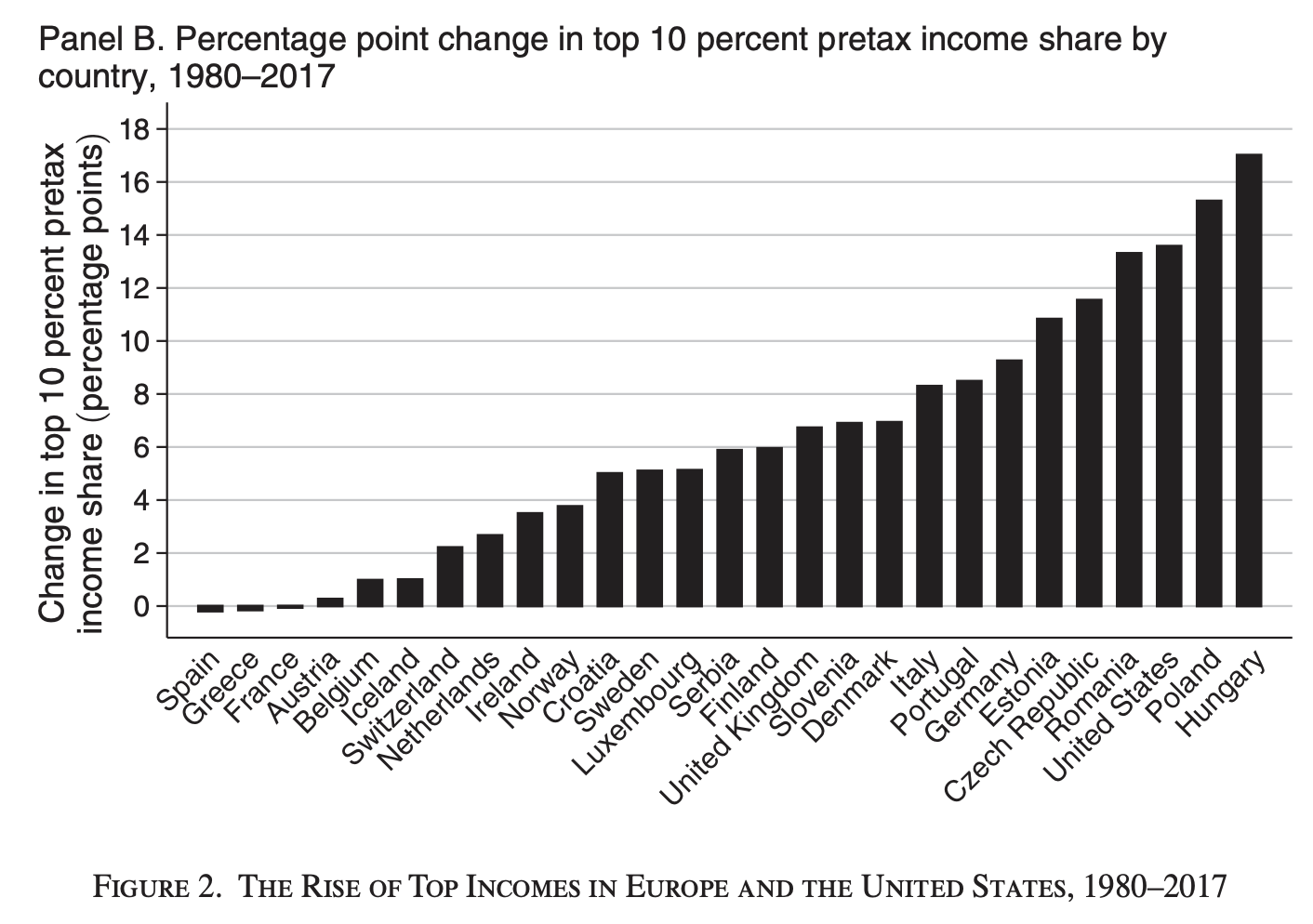

Chaser—Guess which European country has seen the largest rise in upper income share:

Yet another reason for the left to hate on Hungary.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.