• Warren Buffett has been a Democrat most of his life for some foolish reason (his father was a conservative Republican congressman from Nebraska who wrote occasionally for Human Events in the 1950s), but now and then he wakes up to the economic idiocy and predacity of Democrats. As you may know, President Biden, following the lead of Bernie Sanders and Elizabeth Warren, attack stock buy backs as “giveaways” to insiders, and Biden’s Inflation Reduction Tax slapped a 1% excise tax on corporate stock buybacks, and wants to raise this to 4%.

Buffett’s annual letter to Berkshire-Hathaway shareholders, released over the weekend, swats at this idea albeit without mentioning Biden:

Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect. Imagine, if you will, three fully-informed shareholders of a local auto dealership, one of whom manages the business. Imagine, further, that one of the passive owners wishes to sell his interest back to the company at a price attractive to the two continuing shareholders. When completed, has this transaction harmed anyone? Is the manager somehow favored over the continuing passive owners? Has the public been hurt?

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).

• In related news, the Wall Street Journal today looks closer at the decision of the mega-fund manager Vanguard to eschew ESG (environmental, social, governance) investing, which is the new thing of the greenies, actively backed with the force of Biden Administration. This is merely another pressure point of the climatistas’ efforts to strangle traditional energy (i.e., oil, gas, and coal—in other words, affordable energy that works).

It was likely inevitable that Vanguard would defect from the green banking cartel at some point for a very simple reason: Vanguard pioneered the S&P 500 index fund (which over the long term beats something like 75% of actively managed stock funds), and you can’t run a legitimate index fund if you don’t include the traditional energy sector, which was the best performing sector in the stock market last year. Any fund that claims to be an index fund but omits fossil fuel companies will lag the market. At some point, I hope there are massive shareholder lawsuits against green investment funds for ignoring their primary fiduciary responsibility.

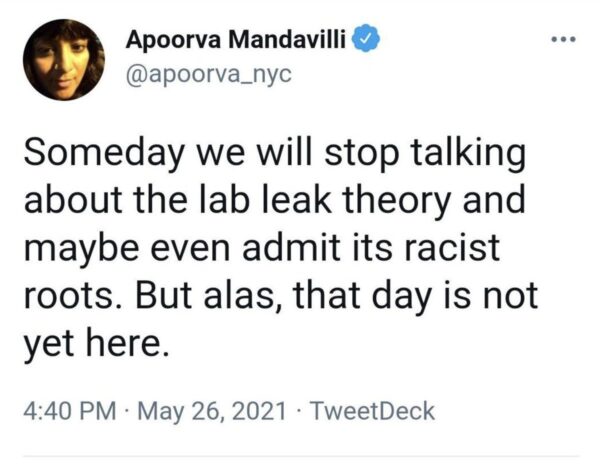

• Reminder: If you promoted the lab-leak hypothesis for the origin of COVID-19 that is now accepted by the Biden Administration, you were a racist and a bigot:

Is there any good reason not to burn down the entire New York Times and salt the earth underneath it? Oh, right—too many greenhouse gas emissions.

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.