As if this writing (Sunday afternoon), there is high uncertainty about whether the failure of Silicon Valley Bank will spread to other banks this week. There are good reasons to think SVB’s failure was peculiar to Silicon Valley and atypical of most banks. A senior bank analyst of my acquaintance pointed out to me that over 80% of SVB deposits were over the $250,000 limit for deposit insurance (I have separately seen higher estimates than that), compared to 40-50% for most large banks. And it appears that SVB was especially bad at managing its interest rate risk. Still, my analyst source doesn’t rule out a contagion effect.

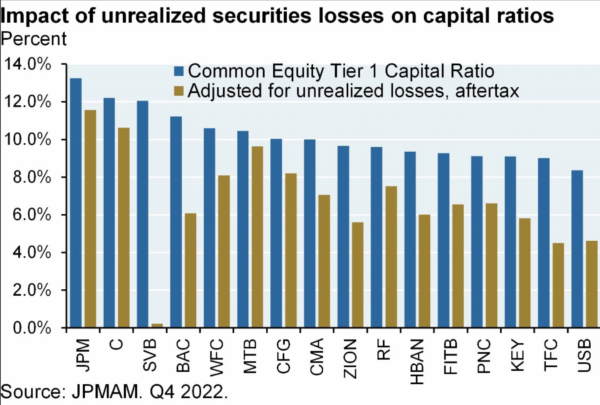

I’m not sure I completely understand this chart (and I don’t know where I got it just now in the torrent of things coming across my screen), but it may be a meaningful measure of how SVB is an extreme outlier (I think this represents the original book value of SVB’s reserve assets—mostly government MBSs—and the mark-to-market value as a result of rising short-term interest rates that determine the SVB’s cost of capital):

If I have time, I intend to dig into the whole scene further. A few observations in the meantime.

• If you think “pitchfork populism” is a significant force now, imagine what it will look like if the federal government bails out Silicon Valley venture capitalists (whose startups were the most significant depositors in SVB, potentially wiping out their investments).

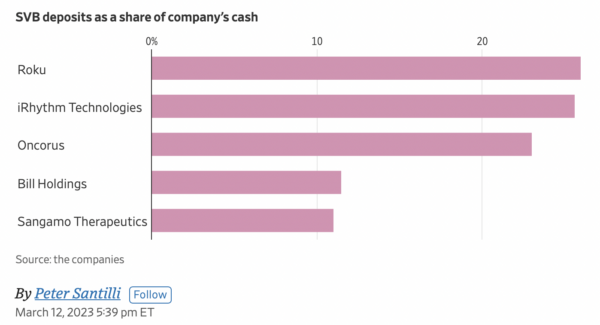

The Wall Street Journal is reporting this afternoon that Roku had $487 million on deposit with SVB—26% of its total working capital. And gives us this chart:

The pressure for a bailout is going to be intense.

• More bad news for California. The state budget is already diving deeper into the red because Silicon Valley’s VC-fueled IPO boom and capital gains machine has crashed, and the SVB failure is going to make this trend worse. Have fun running for president, Gavin.

• SVB appears to be a fully woke bank:

• The Federal Reserve is going to have a difficult time raising rates again. There was some speculation, after the latest bad inflation numbers, that the Fed might go with another 50 basis point hike this month, but now everyone thinks they might not even go 25 basis points for fear of spooking the banking system. People with long-term memory (like me) will recall that the Fed reversed course on a dime in the summer of 1982 when it appeared the global banking system was on the precipice, even though inflation was still higher than it is today. Will the Fed blink?

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.