One of the things about the conventional wisdom is how often you can rely on it being wrong. Statistics show that 95 percent of all conventional wisdom claims are wrong. Actually, I made that statistic up, but I’m sure it is close to being right. Maybe the Monkey Cage can get right on it and let me know.

For a long time the conventional wisdom was that we arrived at “peak oil.” My pal Rob Bradley revisits this old Malthusian chestnut today over at the MasterResource blog, and it is not to be missed:

“This time it’s for real,” says the cover story of the June 2004 issue of National Geographic. “We’re at the beginning of the end of cheap oil.”

Books and articles written by geologists, environmentalists, and others regularly announce a new era of increasing oil scarcity…

Read the whole thing—originally published in 2004—which predicted our current oil glut at precisely the moment the conventional wisdom said it’s all over for oil! (Hat tip and major props to Rob, who, incidentally, is the co-author of one of my favorite energy books, Energy: The Master Resource. Time for a new edition, Rob!)

Anyone remember Goldman Sachs predicting that oil was headed to $200 a barrel? Now, the Wall Street Journal reports this morning, the smart people who predicted $200 oil are now predicting that oil, today hovering around $30, could fall as low as $16 a barrel:

Money managers in near-record numbers are betting that oil prices will fall even lower, spurring analysts to cut their own forecasts again. Morgan Stanley on Monday joined Goldman Sachs Group Inc. in suggesting crude could hit $20. Royal Bank of Scotland Group PLC has called for $16, and Standard Chartered PLC said prices could fall as low as $10.

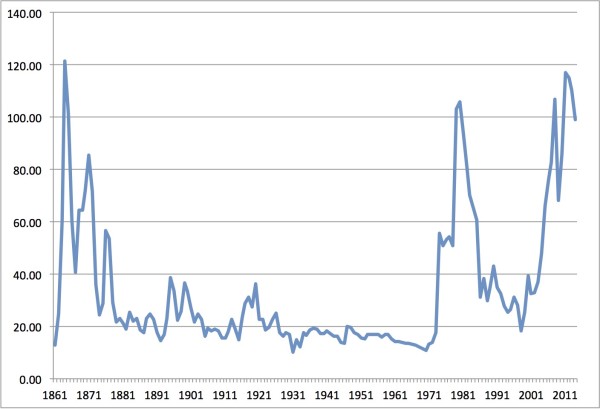

In other words, oil is falling back to its historic, long-term inflation adjusted price. Here’s the inflation-adjusted price chart I generated last night from last year’s BP Statistical Survey of World Energy, which only takes the price up through the end of 2014, and therefore doesn’t accurately depict the price drop of the last year. But use your imagination, and you can see how we’ve reverted to the mean. I’m sure there will be more price cycles in the future, but there’s reason to think that OPEC won’t be able to squeeze $100 oil again in the future, for the simple reason that the technology has evolved to the point that the rest of the world can bring new supply on quickly and very profitably if the price (i.e., demand) spikes.

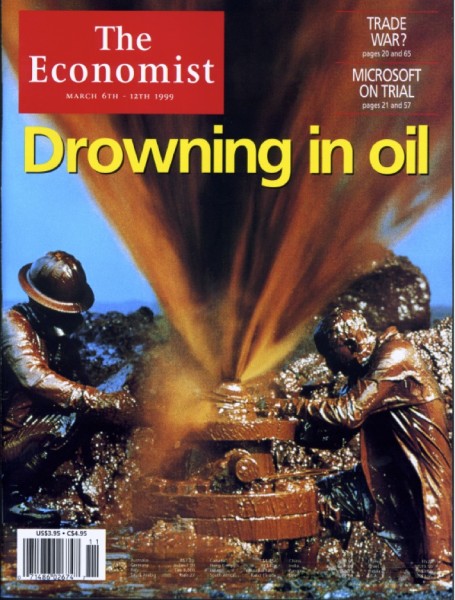

And maybe The Economist will re-run this 1999 cover again some time soon:

Notice: All comments are subject to moderation. Our comments are intended to be a forum for civil discourse bearing on the subject under discussion. Commenters who stray beyond the bounds of civility or employ what we deem gratuitous vulgarity in a comment — including, but not limited to, “s***,” “f***,” “a*******,” or one of their many variants — will be banned without further notice in the sole discretion of the site moderator.